Protecting Your Portfolio Against Inflation's Impact

- Chris Harris, FMVA

- Aug 21, 2025

- 3 min read

Natural disasters teach us valuable lessons about preparation. Just as earthquakes strike suddenly while erosion occurs gradually, both demand strategic planning and protective measures. The same principle applies to economic challenges - the most significant threats to households and businesses aren't always immediate and visible, but can unfold over extended periods. Today's inflation exemplifies this dual nature, presenting both rapid price spikes and the slow deterioration of purchasing power that impacts financial markets.

Those who experienced the inflation surge of the 1970s and early 1980s, or the price increases following the pandemic, will recognize this dynamic. Current inflation remains more persistent than desired, with ongoing concerns that tariffs may elevate consumer prices. However, today's inflationary environment coincides with robust employment, strong consumer spending, and solid corporate earnings. This creates a nuanced landscape for investors and policymakers as they navigate the balance between economic growth and price stability.

The gradual erosion of purchasing power

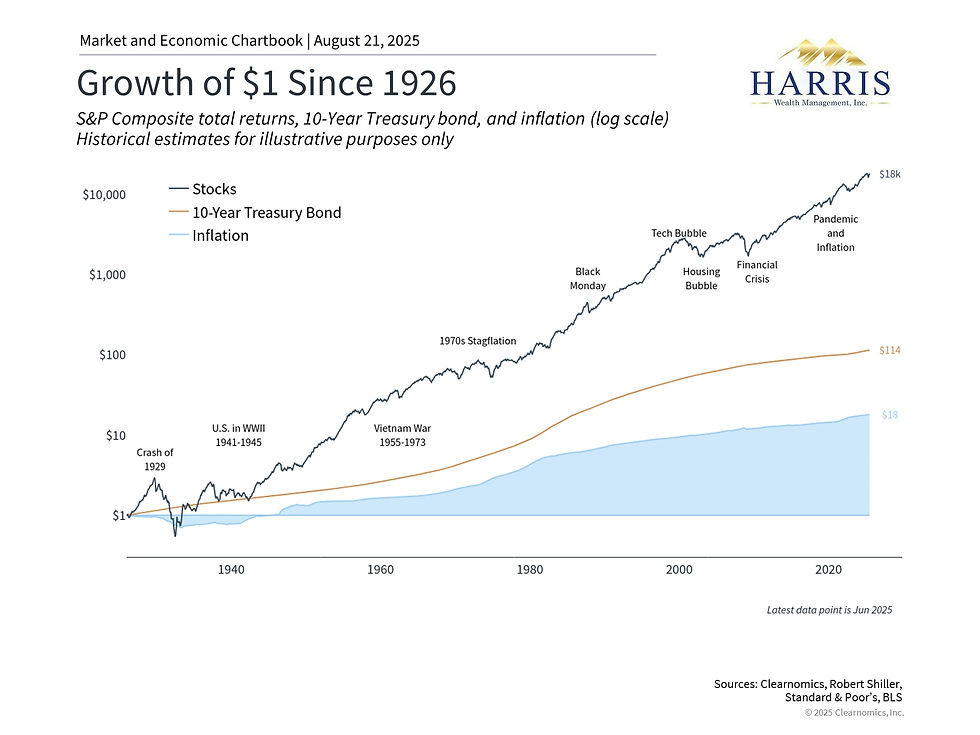

Investors, savers, and retirees recognize that combating inflation represents a fundamental investment objective. Preserving the buying power of portfolios and savings accounts through various investment vehicles - stocks, bonds, certificates of deposit, or alternative investments - remains essential for maintaining future financial security. The accompanying data illustrates this reality starkly: goods costing $1 a century ago now require $18, with acceleration evident during the 1970s and recent years.

While zero inflation or deflation might appear beneficial, price changes reflect broader economic health. Contemporary economic theory suggests that modest positive inflation, typically around 2%, creates optimal conditions for individuals and the overall economy. This moderate rate provides central banks flexibility for monetary policy implementation while preventing deflationary cycles where falling prices encourage delayed consumer purchases.

Even seemingly manageable inflation rates of 2-3% compound significantly over time. At 3% annual inflation, costs double approximately every 24 years. This means $100,000 in current purchasing power would require $200,000 in two decades - spanning typical retirement periods. Such erosion particularly challenges retirees and cash holders, creating a "hurdle rate" that investment returns must exceed to build wealth.

Current inflationary pressures persist

Recent economic data reveals concerning trends in pricing pressures. The Producer Price Index showed wholesale prices surging 0.9% in a single month, marking the largest increase since June 2022 and exceeding economist expectations. Goods prices rose 0.7% while services jumped 1.1% during this period.1

These wholesale increases typically appear in consumer prices with several months' delay as inflation moves through supply chains. The Consumer Price Index demonstrates less dramatic but still persistent price growth, with headline inflation at 2.7% annually and core inflation at 3.1% when excluding food and energy.2 Housing costs drove much of this increase, while consumers face notable price jumps in restaurant meals (3.9%), medical care (3.5%), and car insurance (5.3%).

Strategic asset allocation for inflation protection

Despite current increases, inflation remains below the double-digit rates of 2021-2022. However, tariffs may elevate average price levels over time, particularly if wage growth lags behind price increases and investors lack appropriate long-term allocations.

The data reveals that average cash interest rates haven't matched inflation historically. Money market fund holdings remain at record highs of $7.1 trillion despite declining short-term rates.3 While past performance doesn't guarantee future results, history demonstrates that both stocks and bonds have exceeded inflation over extended periods, though stocks can experience volatility during inflationary periods. Balanced asset class exposure helps investors maintain course through various market conditions.

Inflation gradually erodes purchasing power, making it essential for investors to maintain diversified portfolios capable of generating growth and income over time. Avoiding dramatic portfolio changes based on short-term data helps preserve long-term financial objectives.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Examples are for illustrative purposes only. All investing involves risk of loss including the possible loss of all amounts invested.

Comments