Year-End Tax Strategies to Consider Before the December 31 Deadline

- Chris Harris, FMVA

- Dec 12, 2025

- 4 min read

The closing weeks of 2025 present a critical window for investors to review their financial strategies and make adjustments that could significantly affect their tax obligations. Although financial planning should be an ongoing process throughout the year, numerous tax-related deadlines coincide with December 31, making this period particularly important for taking action.

This article explores three key areas where investors should focus their attention: retirement account withdrawals, Roth IRA conversions, and tax-efficient portfolio positioning. Given the complexity of these topics and the unique circumstances that apply to each individual, consulting with a financial professional is essential.

Meeting the December 31 deadline for Required Minimum Distributions

While building retirement savings is a decades-long endeavor, the withdrawal phase is equally critical to financial success. This becomes particularly important when investors reach the age at which Required Minimum Distributions (RMDs) must begin. Missing the December 31 deadline can trigger substantial IRS penalties—currently 25% of the amount that should have been withdrawn.

RMDs represent mandatory annual withdrawals from traditional IRAs, 401(k)s, and similar tax-deferred accounts once an individual reaches a specific age. Thanks to the SECURE 2.0 Act enacted in 2022, the RMD age increased to 73 for individuals who turned 72 after December 31, 2022, with a further increase to 75 scheduled for 2033.

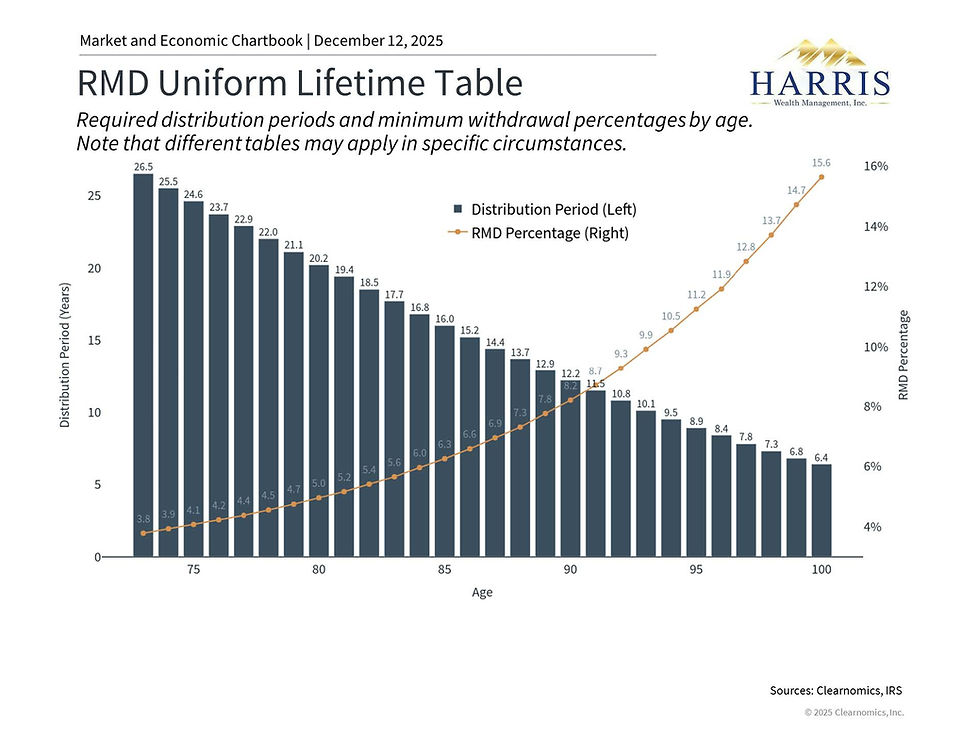

The accompanying chart illustrates current distribution periods and corresponding withdrawal percentages. These amounts are calculated using the prior year's December 31 account balance and IRS life expectancy tables. Several planning considerations merit attention:

Withdrawal sequencing: Strategic planning is required to determine which accounts to tap first and how to coordinate RMDs with other income sources. The withdrawal sequence can substantially impact overall tax liability, particularly since Social Security benefits may become taxable at certain income thresholds.

Initial year flexibility: First-time RMD takers can delay their initial distribution until April 1 of the following year. However, this approach necessitates taking two RMDs in year two, potentially resulting in higher tax bracket exposure.

Alternative approaches: Strategies like Qualified Charitable Distributions (QCDs) enable investors to fulfill RMD requirements by directing funds to qualified charities, avoiding taxable income. Proper timing is crucial for maximizing these benefits.

Before reaching age 73, investors should evaluate whether voluntary distributions make sense. Taking withdrawals to "fill a tax bracket" can be advantageous for those expecting higher tax rates once RMDs commence. Effective retirement planning requires a multi-year outlook rather than focusing on individual tax years.

Strategic advantages of Roth conversions in the current tax environment

Roth conversions represent another valuable planning opportunity with a December 31 deadline. These transactions involve moving assets from a traditional IRA to a Roth IRA, creating immediate taxable income in exchange for future tax-free growth and withdrawals. Unlike standard Roth contributions with income limitations, conversions are accessible to all investors.

The "One Big Beautiful Bill" recently passed by Congress made permanent the lower tax rates established under the Tax Cuts and Jobs Act. This legislative change, combined with concerns about rising future tax rates due to growing national debt, makes current tax rates potentially more favorable than what investors might face later.

Important factors for Roth conversion decisions include:

Current versus future tax rates: Compare your present tax bracket with anticipated retirement rates. If future rates are expected to be higher due to RMDs, pensions, or Social Security, converting now at lower rates may prove beneficial.

Growth timeframe: The longer assets can compound tax-free in a Roth account, the more advantageous the conversion becomes, making earlier conversions generally preferable.

Medicare cost implications: Conversion income can trigger higher Medicare premiums through IRMAA adjustments. While this doesn't automatically rule out conversions, it should factor into the overall evaluation.

Using tax-loss harvesting to optimize portfolio tax efficiency

While the previous strategies focus on retirement accounts, tax-loss harvesting applies to taxable investment accounts and can help minimize current tax obligations. This approach involves selling depreciated investments to realize capital losses that offset gains recognized earlier in the year. Like other year-end strategies, tax-loss harvesting must occur before December 31 to affect the current tax year.

The mechanics are straightforward: realized losses can offset realized gains on a dollar-for-dollar basis. Even without significant gains, investors can apply up to $3,000 of net losses against ordinary income annually, with excess losses carried forward indefinitely.

Key considerations include:

Tax rate differentials: Long-term capital gains (from investments held over one year) receive preferential tax treatment at 0%, 15%, or 20% rates, while short-term gains face ordinary income rates. Harvesting losses to offset short-term gains offers particular value, especially for high-tax state residents.

Wash sale restrictions: The wash sale rule prohibits repurchasing identical or substantially similar securities within 30 days before or after the sale. However, investors can maintain market exposure by replacing positions with similar but not identical investments, such as different ETFs.

Account type limitations: Tax-loss harvesting only applies to taxable brokerage accounts, not IRAs or 401(k)s, since transactions within retirement accounts don't create taxable events.

The true value of year-end planning emerges from integrating these strategies effectively rather than implementing them in isolation. While reducing immediate tax liability is important, it should align with broader financial objectives. Optimal planning balances short-term tax impacts with long-term wealth accumulation goals.

We wish you and your family a wonderful holiday season!

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Examples are for illustrative purposes only. All investing involves risk of loss including the possible loss of all amounts invested.

Comments