Year-End Charitable Planning: Optimizing Your Philanthropic Strategy

- Chris Harris, FMVA

- Dec 3, 2025

- 5 min read

Winston Churchill is often credited with saying that "it is more agreeable to have the power to give than to receive." The year-end period naturally prompts reflection on charitable contributions and their role within a holistic financial strategy. Strategic charitable planning serves dual purposes: advancing philanthropic objectives while enhancing tax efficiency. The key question extends beyond simply deciding to give—it involves determining the most effective methods to maximize impact on meaningful causes while optimizing your financial situation.

This tax year offers distinctive planning opportunities. The One Big Beautiful Bill Act (OBBBA), recently enacted, contains provisions that affect charitable giving considerations. Furthermore, contributions counting toward this tax year must be completed by December 31, establishing a defined timeframe for strategy review. Learning how to effectively structure charitable contributions can elevate generosity from a spontaneous act to a fundamental component of your financial planning approach.

American household wealth has climbed to unprecedented heights

According to the National Philanthropic Trust, Americans contributed $593 billion to charitable organizations in 2024, representing a 6.3% increase over 2023.1 This demonstrates that philanthropy continues to be a significant priority for many families, despite a decline in the overall percentage of Americans making donations in recent years. As illustrated in the accompanying chart, household wealth has grown consistently alongside economic expansion and stock market gains. Rising income and asset levels, combined with tax code modifications, have established new motivations for charitable contributions.

Philanthropy also serves a crucial function in estate planning strategies. Charitable bequests are exempt from estate taxation, making them an effective method to decrease estate tax obligations while supporting meaningful causes. For individuals with estates substantial enough to trigger estate tax, combining lifetime charitable giving with estate bequests can meaningfully reduce the tax burden inherited by beneficiaries.

Most fundamentally, charitable giving enables families to establish lasting legacies, strengthen shared values across generations, and minimize lifetime tax obligations. For many families, philanthropy provides an avenue to engage children and grandchildren in substantive conversations about principles and responsible stewardship. The complexity for investors lies in the fact that while the motivation to give is clear, implementing the most advantageous approach demands careful consideration.

Strategic timing and structuring have become increasingly critical

The OBBBA has introduced significant modifications affecting charitable contributions. Most notably, it expands the pool of taxpayers who can itemize deductions by raising the state and local tax (SALT) deduction ceiling from $10,000 to $40,000. Because charitable contributions only provide tax benefits when itemizing, this change amplifies their significance in current tax planning.

Furthermore, a limited window exists from 2025 through 2029 to optimize gift timing and structure. Beginning in 2026, the OBBBA establishes a charitable deduction floor for itemizers set at 0.5% of adjusted gross income (AGI). This means only charitable contributions exceeding 0.5% of AGI will qualify for deductions. For instance, an individual with $200,000 in AGI would only receive deductions for donations above $1,000 (0.5% of $200,000).

Some investors employ a strategy called "bunching" to address this limitation, consolidating multiple years' worth of charitable contributions into a single tax year to surpass the deduction threshold. This technique has gained traction since the 2017 Tax Cuts and Jobs Act substantially increased the standard deduction, thereby reducing the proportion of households itemizing deductions.

Selecting which assets to donate represents another important decision point. Donating highly appreciated securities provides three distinct tax advantages: it eliminates capital gains tax that would result from selling the securities, removes future appreciation from the taxable estate, and generates a deduction against ordinary income. For ordinary income deductions, factors to evaluate include whether the recipient qualifies as a public or private charity and the donor's projected AGI. This "triple benefit" proves particularly valuable during years with substantial capital gains, such as when equity compensation vests or following the sale of a business, particularly when offsetting losses are unavailable.

Incorporating charitable giving into portfolio rebalancing strategies can further improve tax efficiency. Some investors strategically gift appreciated assets from taxable accounts, then replace those positions through purchases in tax-deferred accounts. This methodology preserves the target asset allocation while optimizing tax advantages.

Common vehicles for philanthropic contributions

Various charitable giving mechanisms serve distinct purposes, and choosing the appropriate vehicle depends on individual circumstances and objectives. Below are several prevalent examples, though this list is not comprehensive:

Donor-advised funds (DAFs)

have experienced substantial growth, with total assets surpassing $250 billion.1 DAFs operate similarly to charitable investment accounts: contributors make a donation, obtain an immediate tax deduction, and subsequently recommend grants to charities over time. The contributed funds can be invested and appreciate tax-free while donors deliberate on grant timing and recipients. DAFs prove especially beneficial during years when maximizing deductions is a priority.

Under current tax regulations, donors can structure DAF contributions to ensure they exceed the 0.5% AGI floor threshold discussed earlier. DAFs also offer greater simplicity compared to alternative options, making them accessible to a broader range of contributors.

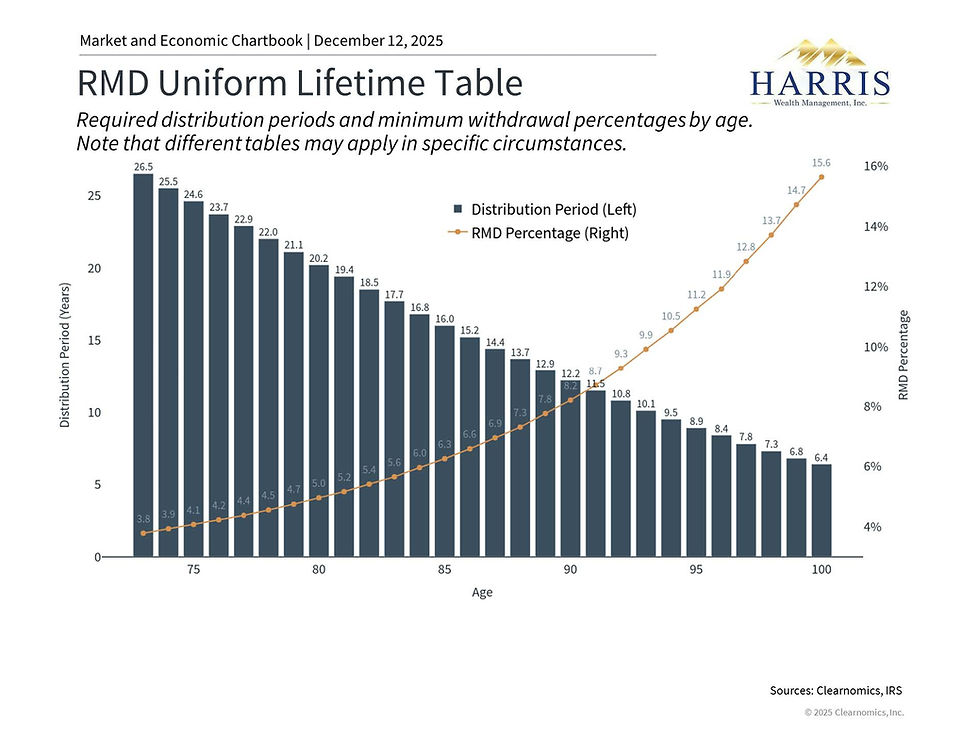

Qualified charitable distributions (QCDs) represent another avenue for individuals aged 70½ or older who maintain traditional IRAs. QCDs permit direct transfers up to $108,000 for tax year 2025 from an IRA to qualified charities. This can fulfill required minimum distribution (RMD) obligations while excluding the transferred amount from taxable income. QCDs deliver tax benefits independent of itemization status, making them valuable during years when itemized deductions provide less benefit.

Charitable remainder trusts (CRTs) offer an additional mechanism for supporting charitable causes within estate planning frameworks. With a CRT, assets are transferred to a trust that distributes income to beneficiaries for a defined period, with remaining assets ultimately going to charity. This proves particularly advantageous for highly appreciated assets, as the trust can liquidate them without the donor incurring immediate capital gains taxation.

As with any trust instrument, careful attention to structure is essential. For instance, retaining certain powers could result in including the asset in the grantor's taxable estate. Furthermore, designating beneficiaries other than the grantor or spouse may trigger gift tax consequences.

For individuals fortunate to possess substantial assets and long-range philanthropic objectives, additional considerations may encompass:

• Private foundations, which provide maximum control and family governance frameworks but entail higher administrative burdens, minimum distribution requirements, and excise taxes on investment income

• Charitable lead trusts, which distribute income to charity for a specified period before transferring assets to heirs

• Supporting organizations, which collaborate closely with particular public charities

• Pooled income funds provided by certain charitable institutions

These examples represent frequently utilized charitable giving vehicles, though additional options and variations may be suitable depending on specific circumstances. Consulting with a trusted advisor can help identify which approach best aligns with your objectives.

Integrating philanthropy into comprehensive financial planning

The most successful charitable planning incorporates giving into your overall financial strategy rather than treating it as isolated from other financial decisions. This comprehensive approach examines how charitable contributions intersect with investment management, tax planning, retirement income strategies, and estate planning.

Perhaps most significantly, including children and grandchildren in philanthropic decision-making generates opportunities to discuss what matters most to your family, why particular causes merit support, and how to assess nonprofit effectiveness. These discussions can represent some of the most valuable elements of wealth planning, helping ensure that your family's principles and commitment to stewardship endure across generations.

We hope you have a wonderful holiday season!

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Examples are for illustrative purposes only. All investing involves risk of loss including the possible loss of all amounts invested.

Comments